A group of professionals engaged in practical work related to vehicle management across a diverse range of asset classes.

We have developed reliable executive systems through the creation of internal control systems.

Tokyo Kyodo Accounting Office is a pioneer in vehicle management services for structured finance in Japan. We created a specialized department in the early days of this market, and have developed a system for offering thorough support for all practical work, from the establishment of SPCs, to management during operation, and their closing.

We mainly provide administration services with a focus on fund management. We have a track record of taking on these services for more than 8,000 companies in Japan and overseas as a group of professionals engaged in practical work. This includes securitization vehicles to raise funds for originators, as well as real estate securitization SPCs, renewable energy project SPCs for solar power, wind power, etc., SME rehabilitation fund and buyout fund management, and J-REIT accounting and taxation services.

We offer comprehensive administrative services for a wide range of vehicles such as TMK(tokutei mokuteki kaisha) , GK(godo kaisha )-TK (tokumei kumiai) structure and also other Japanese SPC(voluntary partnerships, LPS(limited partnerships)) as well as SPC incorporated in the Cayman Islands and various overseas partnerships.

We provide practical services from a project setting-up to on-going operation and project closing. In case a decline in value and liquidity or a default in a project happen, we will take advantage of our extensive experience in administrative services to ensure a realistic and accurate solution from the perspective of protecting investors, etc.

We have created internal controls and are consistently committed to developing frameworks and systems to prevent fraud and errors. This enables us to guarantee service quality across our organization, not just for specific people, and offer highly reliable services. We have also established IT infrastructure that can be securely operated remotely, ensuring that funding and other services will not be stopped, even in the event of a disaster or other emergencies.

〈Third-party certification for internal controls〉

〇Statement on Standards for Attestation Engagements by the American Institute of Certified Public Accountants: AT-C Section 320(AT-C320), AT-C Section 105(AT-C105), AT-C Section 205(AT-C205)

〇International Standard on Assurance Engagements (ISAE) 3402 “Assurance Reports on Controls as a Service Organization” by the International Auditing and Assurance Standards Board)

We endeavor to enhance convenience for our clients with our prompt service to address a wide range of tasks related to reporting, which is becoming increasingly diverse and important, including convergence with International Financial Reporting Standards (IFRS) and group accounting packages.

We offer practical advice and support for all processes from structure creation to a vehicle establishment, contract review, etc., and contract conclusion.

■Closing support

Integrated support for projects through advice and comments at every step, from initial documentation reviews for contracts through contract conclusion

■Vehicle establishment

Support for the establishment of SPCs such as GK(godo kaisha ) or TMK(tokutei mokuteki kaisha)

■Representative dispatch and location provision

We can also dispatch officers as required for the establishment of SPCs, and liquidators for dissolution, and provide a head office location

■Schedule management and database preparation

Representatives with a detailed understanding of the project will create databases of information to ensure trouble-free management after the conclusion of the contract while preventing omissions of information through double-checking by both the data registrator and the data approver

We will quickly respond to any amendments to laws and regulations, and address various governance demands required for vehicle management on our own initiative.

■Articles of incorporation, general meetings of shareholders, and public notices

Registration of corporate establishment, change, dissolution, and liquidation, registration of changes in rights, and the management of ordinary and extraordinary general meetings of shareholders and the preparation and statutory public notice of related minutes and business reports (electromagnetic methods offered for public notice of financial results)

■Work with the Financial Services Agency and local finance bureaus

Notifications pursuant to the Financial Instruments and Exchange Act, Act on Securitization of Assets, Foreign Account Compliance Act (FATCA), Foreign Exchange and Foreign Trade Act, Act on Specified Joint Real Estate Ventures, etc.

■Advisory services related to the Common Reporting Standard (CRS)

■Establishment and closure of Japanese branches for non-Japanese companies

■Response to legal investigations and issues with projects, and liaison services with attorneys

■Advice on procedures related to corporate organizational changes for mergers, etc.

We offer high-quality accounting and taxation services, based on proper accounting treatment and taxation judgments, and strict management of accounting and taxation deadlines for all vehicles, taking into consideration changes in accounting standards and taxation systems.

■Financial statement preparation

Preparation of trial balances, general ledger, and financial statements. Financial reporting services tailored to our clients’ needs, covering everything from annual results, through quarterly and monthly results

■Preparation and filing of tax returns and notifications

Preparation and filing of various taxation notifications (including consumption tax status management) and taxation returns for corporation tax, corporate inhabitants tax, corporate enterprise tax, consumption tax, etc., as required at any stage, from vehicle establishment, through operation, and closing

■Preparation and filing of various applications

Preparation and filing of applications for issuance of withholding tax exemption certificates for non-Japanese companies or non-residents, application for exemption from taxation on interest of private-sector foreign bonds, etc., interest recipient confirmation documents, and other documents

■Various reporting services

Prompt and accurate reporting in various formats tailored to clients’ needs, including IFRS reports, US-GAAP data, group accounting package data, annual securities report preparation assistance (EDINET filing (including preparation of XBRL data))

We provide cash management services based on provisions in contracts and schemes for each project. We ensure error-free operations through standardization and the creation of internal control systems.

■Payment of vehicle expenses and taxes

We standardize and streamline operations by leveraging schedulers, cash receipt/withdrawal management databases, and operational manuals. Dedicated team members prepare debit slips (including online banking) based on an understanding of payment methods at megabanks and regional banks, ensuring error-free payments. We have created a system to ensure cross-checking and prevent the fraudulent use of funds by having the custody service team stamp debit slips prepared by the funding team.

■Bank account management (opening, closing, change, passbook management)

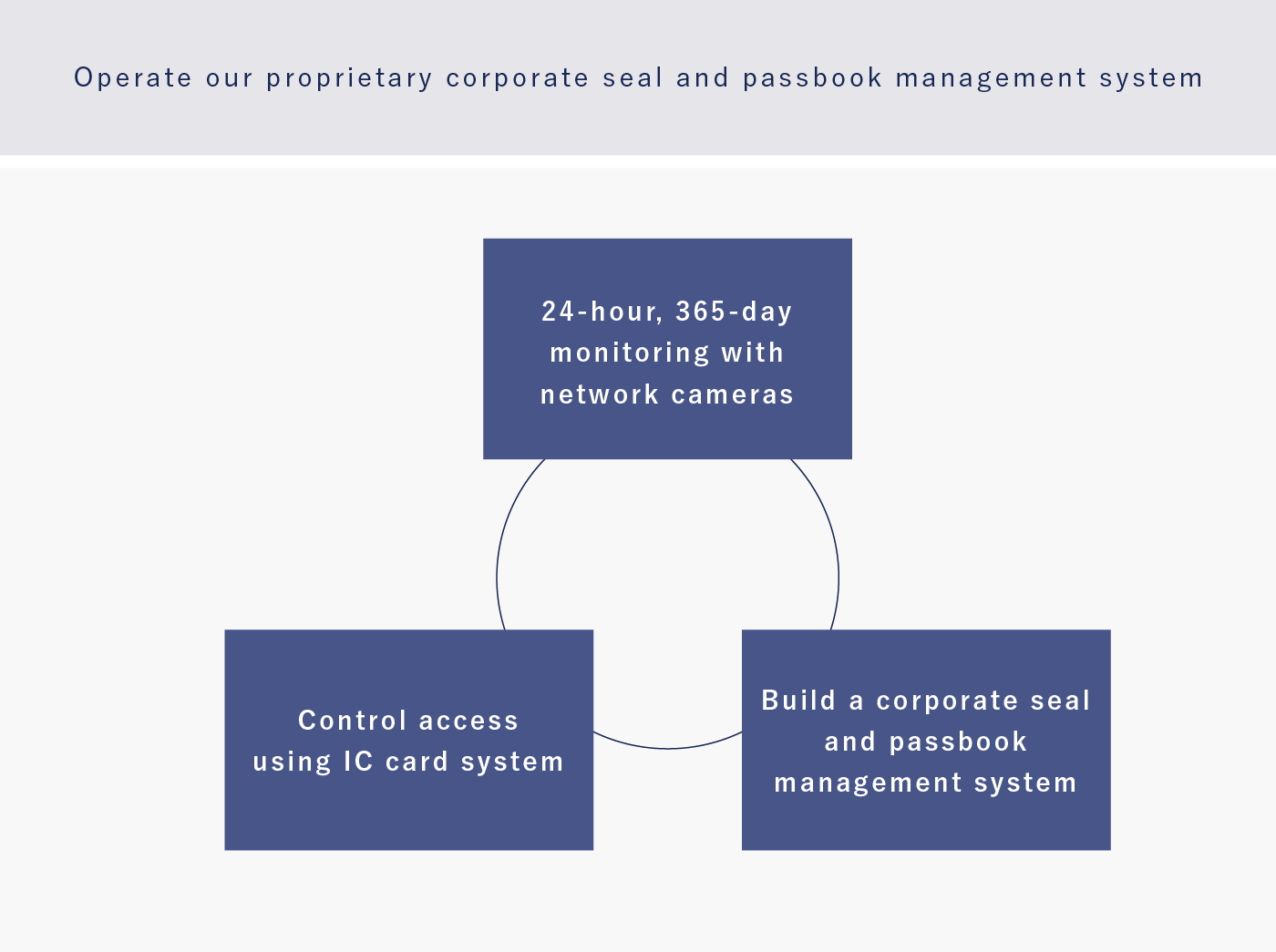

We leverage a proprietary “corporate seal and passbook management system” with IC tags attached to all passbooks to ensure a strict management system, under which inventory is tracked in real-time and incoming and outgoing articles are recorded.

■Team members working exclusively on calculation lead the preparation of waterfall and dividend calculations, as well as LTV, DSCR, and related reports, enabling us to provide high-quality cash management services.

■Other related services

Administrative work related to the payment of capital and other funds, and the preparation and filing of payment records, reports to the Bank of Japan, and other documents

We store and manage important articles, such as vehicle corporate seals and registered certificates of rights. We offer particularly strict management of corporate seals and passbooks through our proprietary “corporate seal and passbook management system.” We also use a document management system called D-System to manage all forms of documents.

■Preparation, storage, and management of seals

We leverage our unique “corporate seal and passbook management system” with IC tags attached to seals to ensure a strict management system, under which inventory is tracked in real-time and incoming and outgoing articles are recorded

■Storage and management of securities, contracts, and other important items

We strictly manage the storage of registered certificates of rights, beneficiary rights certificates, and other important items in vaults with security cameras, to which limited personnel have access. 。Documents pertaining to completed projects are disposed of after storage for a certain period in external storage

We use our D-System for integrated management of all matters pertaining to managed items, from receipt, through storage, preservation, and return or disposal.

■Seal management

Seal-affixing is performed in vaults with security cameras. We prevent fraud and accurately and promptly manage seal-affixing through cross-checking between requesting departments

We provide higher value-added and quality fund administration services, in order to contribute to the development of the Japanese VC and PE industries as a whole.

We offer a platform-type service that includes a comprehensive range of services in a one-stop manner. This covers all work related to partnership operation required for every process, from fund establishment to dissolution and liquidation, outside of investment activities. Since launching these services in 2018, we have already been entrusted with the management of funds in excess of 1 trillion yen in commitment terms.

We have knowledge on various matters necessary for the operation of investment limited partnerships and other partnerships. Accordingly, we provide higher value-added services as a trusted discussion partner, capable of offering accurate advice on issues faced by clients operating partnerships.

Representative services are shown below, but we will flexibly design and propose services in accordance with our clients’ wishes, based on the fact that there is significant variance in the scope of partnership operation work being outsourced.

■Establishment and registration of investment limited partnerships

■Various measures related to specially permitted services for qualified institutional investors, etc.

Notification and reporting as set forth in laws and regulations, etc.

■Accounting and financial results-related services, audit-related measures, and taxation notifications

Response to the Limited Partnership Act for Investment, Accounting Standard for Financial Instruments, IFRS, US-GAAP, etc.

■Measures related to the statement of partner income, etc.

■Partnership operation based on the partnership agreement

■Calculation for capital calls, distributions, carried interest, etc.

■Notifications to investors (preparation and sending of notifications), etc.

■Bank account opening, remittances, payment confirmation, tax payment procedures, and reports to the Bank of Japan

■Storage of important items such as seals, passbooks, and contracts

■Financial and taxation due diligence for investee companies

■Tax structuring consultation

■Support for the preparation of fair value valuation guidelines

■Support for IP applications and establishment of rights

■Year-end valuation of investee companies

■Partnership liquidation procedures

Registration of dissolution, liquidator, and completion of liquidation, etc.