Global tax planning

We tap into our network of top law and accounting firms overseas that we have developed in the course of our operations in order to propose schemes that simultaneously resolve the accounting and taxation issues in Japan and relevant countries.

We tap into our network of top law and accounting firms overseas that we have developed in the course of our operations in order to propose schemes that simultaneously resolve the accounting and taxation issues in Japan and relevant countries.

With the growth of a borderless economy and borderless business operations, efforts to build supply chains across borders and engage in electronic commerce have become increasingly dynamic. In contrast to the speed that corporate activities and investment activities have gained in expanding into other countries, the international rules on taxation, represented by national tax systems and tax conventions have failed to keep up with the change, resulting in various problems pertaining to taxation of multinational corporations. In addition, industrialized nations face the need to increase their tax resources, caused by the pressure to reduce their fiscal deficits as a result of low tax revenues from slow economic growth and huge fiscal deficits resulting from activities to address the COVID-19 pandemic. Reinforcement of compliance related to tax affairs has become a global movement.

In Japan, tax payment is regarded as a social responsibility of business corporations, and tax ethics are highly regarded in the Japanese business sector. At the same time, however, these corporations suffer from relatively low awareness toward global tax planning and management of tax affairs. Amid the rapid changes in taxation, strategic action is necessary regarding international tax affairs. Otherwise, businesses must bear huge taxation risks notwithstanding their sense of corporate ethics.

Tokyo Kyodo Accounting Office offers a full range of advisory services in accounting and taxation related to international commerce and investment. We tap into our own network of top law and accounting firms overseas that we have developed in the course of our history to develop and propose schemes that simultaneously resolve accounting and taxation issues in Japan and those in relevant countries and support our clients in strategic taxation management.

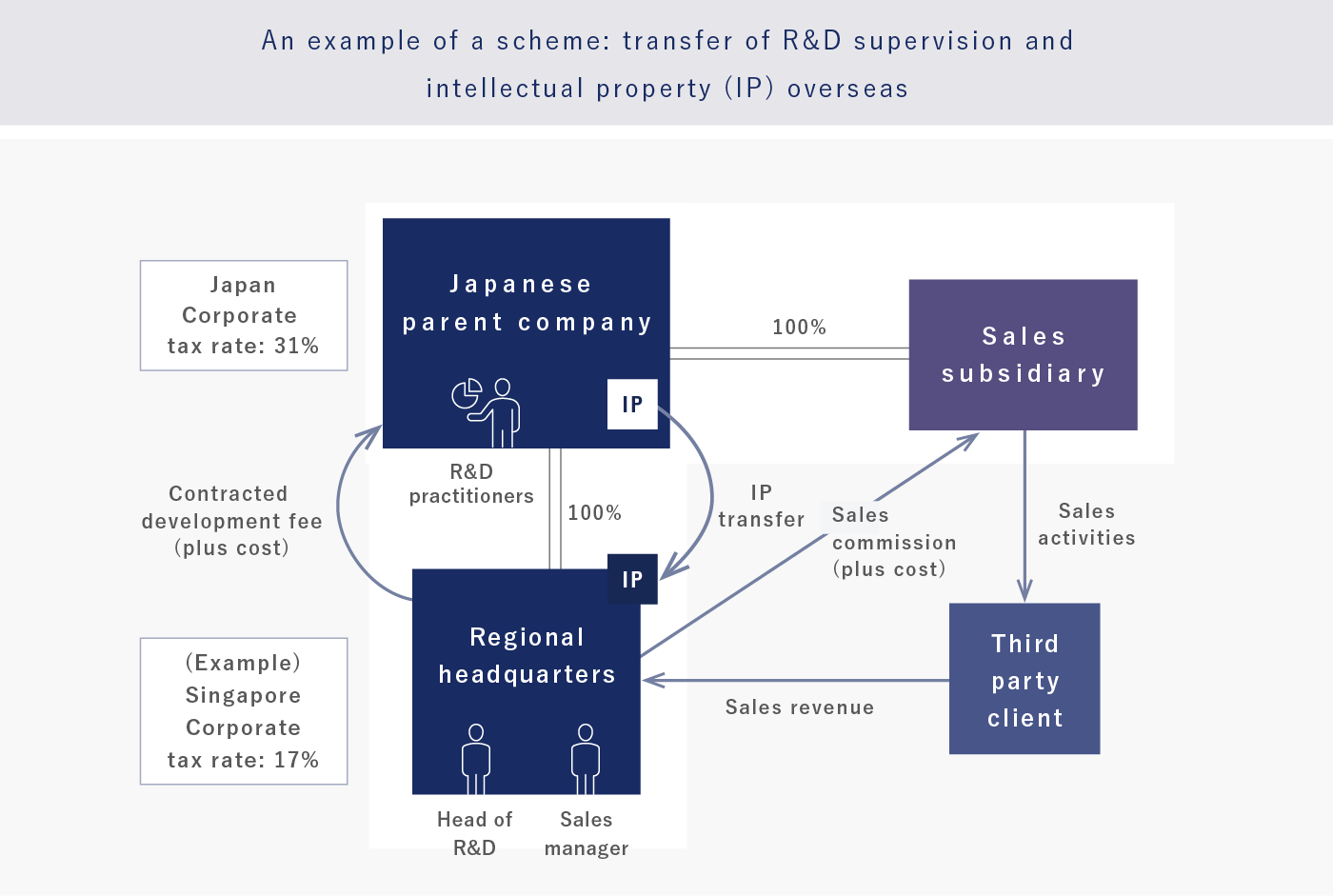

・Non-routine R&D functions can be transferred in phases to regional headquarters, such as one in Singapore, along with patent rights and other related intellectual properties (IPs).

・Products are sold from the regional headquarters to markets around the world.

・Each sales company receives a profit set at a designated level as routine compensation, and the remaining surplus is allocated to regional headquarters in Singapore, etc. The effective tax rate for the entire group can be reduced in this way.

・Certain measures are implemented so that regional headquarters do not become subject to taxation under Japan’s rules on combined taxation for foreign subsidiaries.

Tokyo Kyodo Accounting Office conducts analyses into existing overseas taxation positions chiefly of Japanese companies operating in other countries in order to identify potential issues. At the same time, we offer proposals on improvements that are adapted to client needs from the two perspectives of maximizing after-tax cash flow on the group level and satisfying demands related to consolidated financial statements.

■Taxation advice regarding overseas expansion/establishment of overseas branches and subsidiaries, etc.

■Advice on global tax strategy planning

■Advice on effective use of overseas holding companies and regional headquarters

■Measures for tax haven tax systems/overseas tax deduction planning

■Advice on tax affairs pertaining to improvement of supply chain efficiency

■Advice on tax affairs pertaining to improved efficiency in IP management

■Accounting and taxation services for foreign-affiliated Japanese subsidiaries

■Asset succession and international inheritance involving overseas assets and family members living in other countries