Based on experience and knowledge accumulated by providing advisory services to investors, we offer an integrated range of services covering all aspects of asset formation, inheritance, and business succession.

At Tokyo Kyodo Accounting Office, we provide wealth management services, particularly asset formation, inheritance, and business succession consulting, to corporate owners and landlords. Based on abundant experience of our members in this field, we review and offer advice on measures tailored to the individual circumstances of our clients.

We utilize the expertise and international network we have developed in the structured finance and corporate finance fields.

We plan measures to address issues related to inheritance and business succession in ways aligned with business growth and development, and take care to ensure that such measures and business growth are mutually aligned.

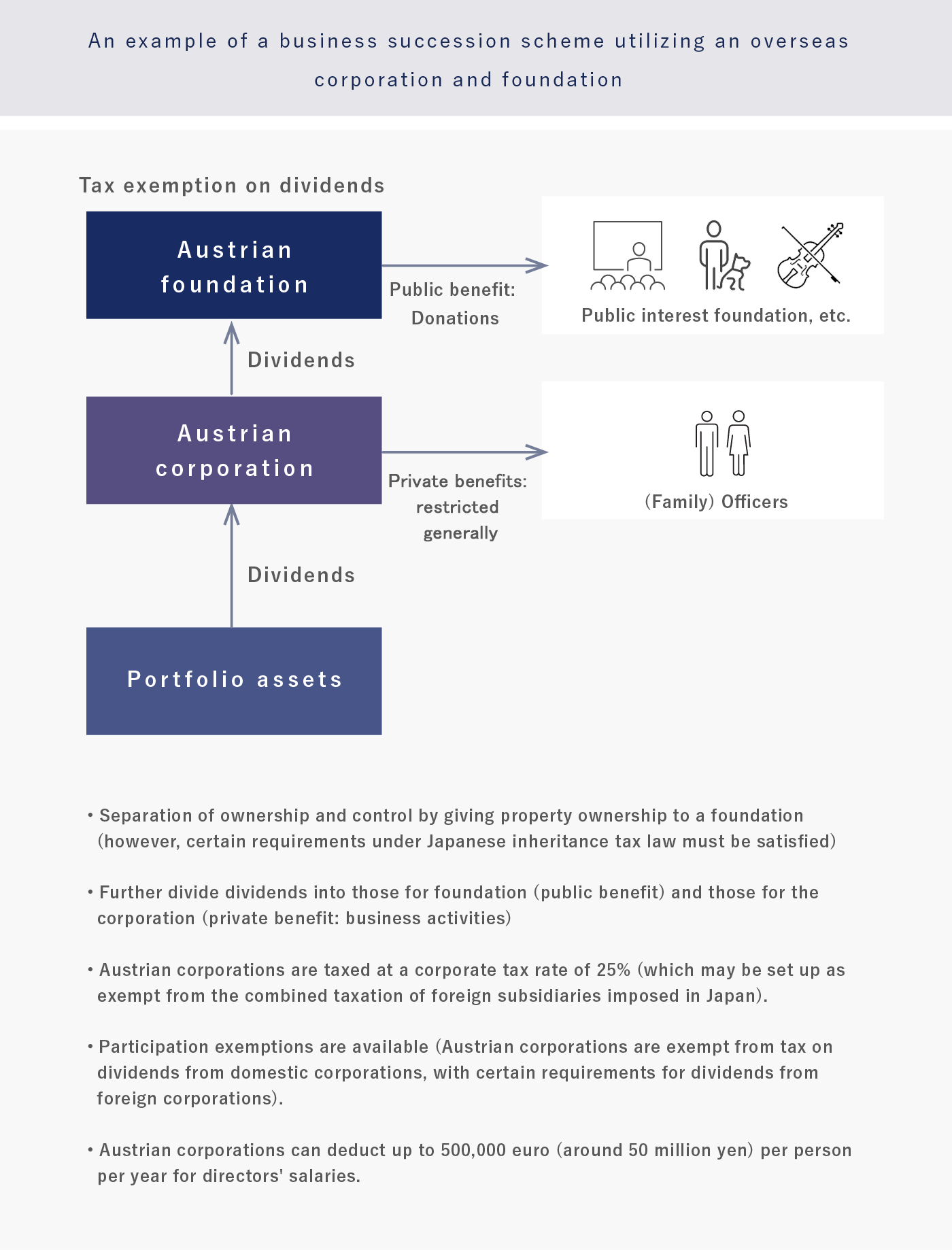

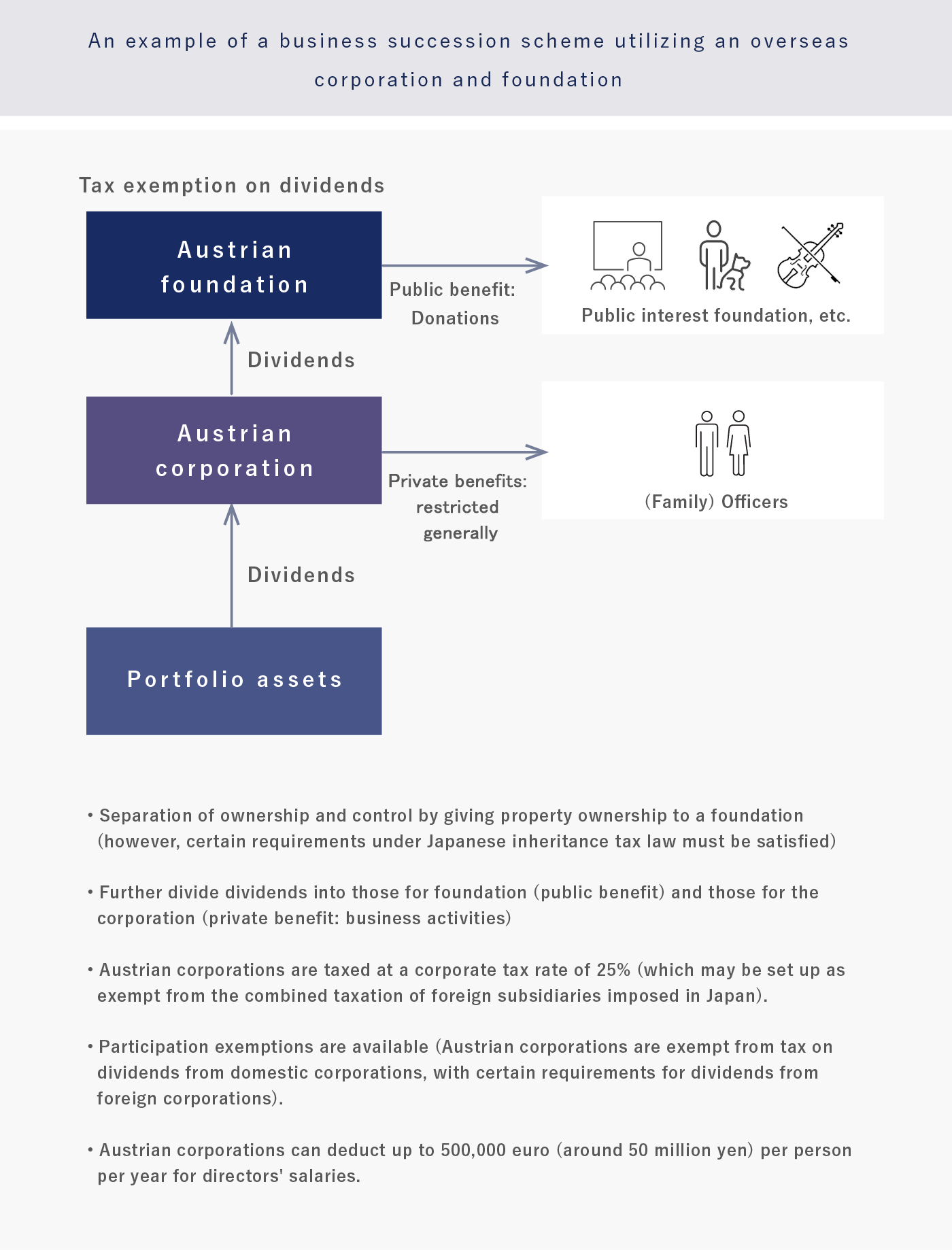

Based on our knowledge of taxation treaties and information concerning local tax laws, etc., from work in the international taxation field, we provide services related to international inheritance, the development of business succession schemes, execution support, etc., to companies operating businesses outside Japan, wealthy clients actively investing overseas, and other clients.

Our specialty is the proposal of innovative business succession methods that are completely compliant with Japanese laws and regulations, backed by our practical experience in Europe, a region with a long history of creating various methods of business succession.

■Taxation advisory services

〇Inheritance measures for family holding companies of non-listed companies (total assets in excess of 10 billion yen)

〇Asset succession measures for non-resident Japanese nationals who are corporate owners

〇Asset succession measures that use foreign holding companies of listed companies

〇Taxation strategies that utilize the asset management companies of the presidents of listed companies (including assets outside Japan)

〇Restructuring advice for the overseas holdings and asset management companies of the presidents of listed companies

〇Formulation of structures for the sale of companies held by owners and immigration outside Japan

〇Establishment, management, and inheritance measures for the asset management companies of presidents of listed companies (including assets outside Japan)

〇Formulation of highly tax-efficient investment structures for investment in real estate outside Japan by residents of Japan and Japanese asset management companies, and Japanese/local tax compliance support

〇Formulation of artist overseas business development and retirement plans

〇Restructuring and asset inheritance measures for when multiple asset management companies are held by the owners of listed companies

〇Transfer of shares in non-listed family companies to asset preservation companies and asset inheritance measures

〇Taxation advice on financial instruments in Japan and overseas, including derivatives and insurance instruments

〇Consolidation of shares from relatives not involved in management, business partners, etc.

〇Consolidation (acquisition) of voting rights utilizing class shares and securing of tax payment funds for heirs

〇Measures related to funds for the payment of taxes utilizing life insurance

〇Formulation of asset inheritance plans utilizing trusts

We utilize the expertise and international network we have developed in the structured finance and corporate finance fields.

We plan measures to address issues related to inheritance and business succession in ways aligned with business growth and development, and take care to ensure that such measures and business growth are mutually aligned.

Based on our knowledge of taxation treaties and information concerning local tax laws, etc., from work in the international taxation field, we provide services related to international inheritance, the development of business succession schemes, execution support, etc., to companies operating businesses outside Japan, wealthy clients actively investing overseas, and other clients.

Our specialty is the proposal of innovative business succession methods that are completely compliant with Japanese laws and regulations, backed by our practical experience in Europe, a region with a long history of creating various methods of business succession.

■Taxation advisory services

〇Inheritance measures for family holding companies of non-listed companies (total assets in excess of 10 billion yen)

〇Asset succession measures for non-resident Japanese nationals who are corporate owners

〇Asset succession measures that use foreign holding companies of listed companies

〇Taxation strategies that utilize the asset management companies of the presidents of listed companies (including assets outside Japan)

〇Restructuring advice for the overseas holdings and asset management companies of the presidents of listed companies

〇Formulation of structures for the sale of companies held by owners and immigration outside Japan

〇Establishment, management, and inheritance measures for the asset management companies of presidents of listed companies (including assets outside Japan)

〇Formulation of highly tax-efficient investment structures for investment in real estate outside Japan by residents of Japan and Japanese asset management companies, and Japanese/local tax compliance support

〇Formulation of artist overseas business development and retirement plans

〇Restructuring and asset inheritance measures for when multiple asset management companies are held by the owners of listed companies

〇Transfer of shares in non-listed family companies to asset preservation companies and asset inheritance measures

〇Taxation advice on financial instruments in Japan and overseas, including derivatives and insurance instruments

〇Consolidation of shares from relatives not involved in management, business partners, etc.

〇Consolidation (acquisition) of voting rights utilizing class shares and securing of tax payment funds for heirs

〇Measures related to funds for the payment of taxes utilizing life insurance

〇Formulation of asset inheritance plans utilizing trusts

Steady preparations should be made for inheritance and business succession measures over a period of time. As representatives of our clients, experienced wealth management experts will provide ongoing support.

Every year, taxation systems related to inheritance and gifts are becoming stricter in Japan. The final outcome may differ significantly depending on whether measures have been put in place in advance. For this reason, at Tokyo Kyodo Accounting Office, when contracted for business succession consulting and inheritance tax filing, we often see cases where clients realize they should have done things in a different way in the past. To put it another way, many clients learn that they had paid more tax than necessary without realizing it.

Business succession requires considering measures from among multiple options, in line with individual circumstances. A wide variety of factors must be considered, including the selection and training of successors, measures related to treasury shares (shift to holding company, organizational restructuring, business succession tax system, etc.), and M&A. Measures related to inheritance and gifts must also be implemented while still alive to ensure that one’s own property is protected and passed onto the next generation without fail.

Preparations for these inheritance and business succession measures should be steadily put in place over a period of time, not rushed in a short time. It is very important to start “advance measures” such as property inventorying and share price calculation as soon as possible. Whether or not such preparations are sufficient may ultimately have a significant effect on the amount of tax that is paid.

At the outset of a consulting project, we identify issues by visualizing invisible concerns after grasping the overall picture, including the status of assets and family relationships, and work with the client to develop solutions together with him or her.

■Business succession measures

〇Officer retirement payment measures

〇Transition to holding company

〇Organizational restructuring (mergers, corporate splits, etc.)

〇Minority shareholder measures

〇Employee shareholding associations

〇Tax deferment for treasury shares

〇Effective utilization of various instruments

〇Utilization of class shares

■Inheritance tax measures

〇Real estate portfolio review

〇Measures against devaluation of small-scale residential land, etc.

〇Tax payment in kind measures

〇Effective utilization of various instruments

〇Gift measures while alive

〇Inheritance tax filing

〇Consideration of asset devaluation

〇Secondary inheritance simulation

■Estate division measures

〇Preparation and review of notarial wills

〇Trusts

〇Effective utilization of life insurance

Steady preparations should be made for inheritance and business succession measures over a period of time. As representatives of our clients, experienced wealth management experts will provide ongoing support.

Every year, taxation systems related to inheritance and gifts are becoming stricter in Japan. The final outcome may differ significantly depending on whether measures have been put in place in advance. For this reason, at Tokyo Kyodo Accounting Office, when contracted for business succession consulting and inheritance tax filing, we often see cases where clients realize they should have done things in a different way in the past. To put it another way, many clients learn that they had paid more tax than necessary without realizing it.

Business succession requires considering measures from among multiple options, in line with individual circumstances. A wide variety of factors must be considered, including the selection and training of successors, measures related to treasury shares (shift to holding company, organizational restructuring, business succession tax system, etc.), and M&A. Measures related to inheritance and gifts must also be implemented while still alive to ensure that one’s own property is protected and passed onto the next generation without fail.

Preparations for these inheritance and business succession measures should be steadily put in place over a period of time, not rushed in a short time. It is very important to start “advance measures” such as property inventorying and share price calculation as soon as possible. Whether or not such preparations are sufficient may ultimately have a significant effect on the amount of tax that is paid.

At the outset of a consulting project, we identify issues by visualizing invisible concerns after grasping the overall picture, including the status of assets and family relationships, and work with the client to develop solutions together with him or her.

■Business succession measures

〇Officer retirement payment measures

〇Transition to holding company

〇Organizational restructuring (mergers, corporate splits, etc.)

〇Minority shareholder measures

〇Employee shareholding associations

〇Tax deferment for treasury shares

〇Effective utilization of various instruments

〇Utilization of class shares

■Inheritance tax measures

〇Real estate portfolio review

〇Measures against devaluation of small-scale residential land, etc.

〇Tax payment in kind measures

〇Effective utilization of various instruments

〇Gift measures while alive

〇Inheritance tax filing

〇Consideration of asset devaluation

〇Secondary inheritance simulation

■Estate division measures

〇Preparation and review of notarial wills

〇Trusts

〇Effective utilization of life insurance