Accounting, taxation, valuation and assurance

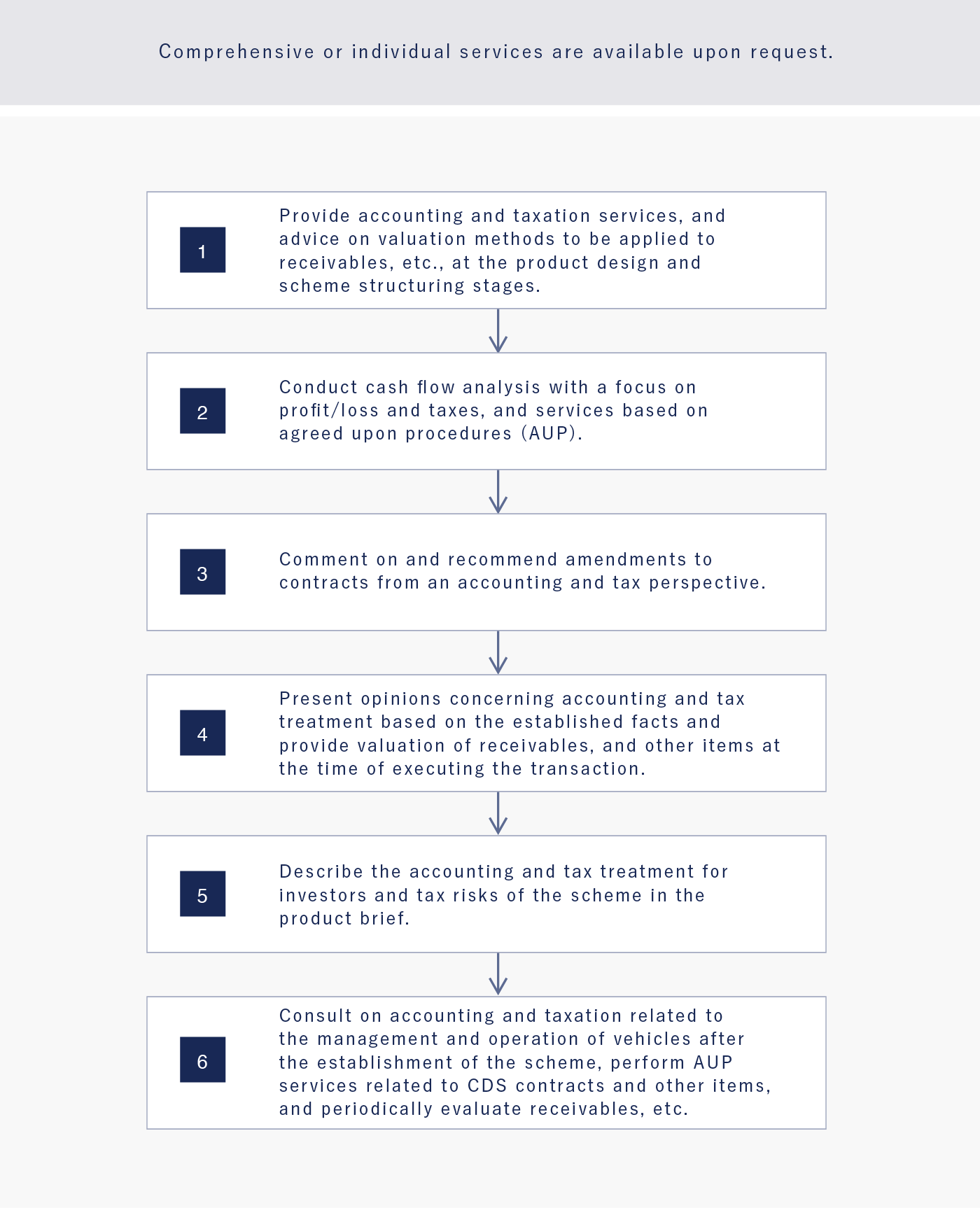

We offer a full range of highly specialized consulting services, covering matters from designing of schemes/instruments to accounting and taxation support for vehicle administration and management.

We offer a full range of highly specialized consulting services, covering matters from designing of schemes/instruments to accounting and taxation support for vehicle administration and management.

Structured finance is Kyodo Accounting Office’s founding business. Since our establishment, we have provided our services to many clients, particularly financial institutions, asset managers, and corporate sponsors engaging in structured finance development and arrangement.

Structured finance refers to advanced financial schemes, in which we use new mechanisms to create financial instruments for each project, and mediate between fundraisers and the providers of funds. At Tokyo Kyodo Accounting Office, we have a substantial track record of structured finance projects, particularly related to real estate and other forms of asset finance.

As experts in accounting and taxation, highly skilled consultants work with teams specializing in vehicle management to provide quality services tailored to our clients’ needs, across all processes, from accounting and taxation advice at the instrument design stage, to advice on vehicle administration and management, agreed upon procedures (AUP), valuation services for claims, etc. We have provided our services to many clients, particularly financial institutions, asset managers, and corporate sponsors engaging in structured finance development and arrangement.

We provide consulting on accounting and taxation precautions necessary for managing and administering financial schemes, as well as practical accounting and taxation services.

We provide consulting on accounting and taxation precautions necessary for managing and administering financial schemes, as well as practical accounting and taxation services.

Consolidated assessment of the vehicle

■SPC subsidiary assessments based on standards of control

■Assessment of applicability of special provisions for SPCs

■Assessment of necessity of consolidation for trusts, investment partnerships (voluntary partnerships, silent partnerships), etc.

■Notes for SPCs subject to disclosure

Assessment of possibility of moving real estate off the balance sheet through securitization

■Assessment methods for moving assets off the balance sheet based on the 5% rule

〇Checking continuing involvement based on contracts, etc.

〇Assessment of validity of transfer value based on real estate appraisal reports

〇Assessment of validity of rent amounts based on real estate appraisal reports, etc.

〇Assessment of property special attributes based on real estate appraisal reports, etc.

〇Lease assessments (see below)

〇Assessment of whether or not the SPC will be classed as a subsidiary of the transferor

〇Handling when there are multiple transferors

〇Assessments of the possibility of moving assets off the balance sheet adjusted for the above

■Assessment of possibility of maintaining off-balance sheet status when refinancing

■Accounting and taxation for assets remaining on the balance sheet (financing)

〇Accounting when keeping assets on the balance sheet and calculation of taxable income for corporation tax

〇Consumption taxes when keeping assets on the balance sheet

Lease assessments

■Approach to lease assessments and specific calculations

〇Summary of assessment methods for accounting and taxation, and their differences

〇Lease assessments related to real estate lease contracts

〇Assessments based on service life standards

〇Assessments of noncancellable periods based on contract terms and conditions

-Assessment of economic life based on appraisals, engineering reports, etc.

〇Assessment based on present value standards

-Calculation of total lease payments

-Calculation of rent amounts for the building portion, within real estate rent for land and buildings as a whole

-Calculation of maintenance and management expenses based on appraisal reports, etc.

-Calculation of discount rates for accounting purposes

-Calculation of interest on liabilities for taxation purposes (assessment of principal and interest rates)

〇Lease assessments using Excel, etc., adjusted for the above and other conditions

■ Accounting and taxation when the transaction is classed as a finance lease

Possibility of moving financial assets, etc., off the balance sheet and accounting treatment

■Assessment of possibility of moving financial claims, etc., off the balance sheet

〇Legal conservation checks in response to legal opinions, etc.

〇Checks of whether the transferor can receive rights

〇Checks of rights or obligations related to repurchase

■Accounting methods for off-balance sheet assets

〇Calculation of gain/loss on sale

-Handling of cash reserves

-Valuation of claims subject to transfer and subordinated interests for calculating gain/loss on sale

-Differences in treatment on non-consolidated/consolidated financial statements

〇Accounting treatment and presentation methods when the transferor holds subordinated interests, etc.

■Handling of new securitization schemes (self-declared trusts/future assignment of claims/trust for dissolution of cross-shareholdings, etc.)

■Loan participation

■Debt assumption

Taxation of securitization of financial claims, etc.

■Withholding taxation, necessity of collecting withholding taxation on interest on securitized corporate bonds, loans, etc.

〇Scheme and contract provisions to ensure that withholding taxation is not imposed

〇Scheme and contract provisions in the event that withholding taxation is collected

■Consumption taxation and assessment of parties subject to consumption taxes on, for example, financing fees and early redemption fees

〇Scheme provisions to ensure that investors are not obliged to pay consumption taxes

■In cases when a specified corporate bond or specified purpose borrowing is securitized, assessment of impact on requirements for recording in the profit and loss of an SPC that is the issuer (borrower)

〇Scheme and contract provisions that do not impact the requirements for recording dividends in the profit and loss of the SPC

Accounting and taxation related to derivatives

■Assessment of whether or not it will be classed as a derivative transaction

■Applicability of hedge accounting

〇Assessment of eligibility for hedge accounting

〇Applicability of expected transactions for hedge accounting

〇Applicability of special provisions for interest rate swaps

■Timing of recognition in profit and loss when applying hedge accounting

■Handling when assets are acquired using derivatives (accounting, corporation taxation, income taxation)

Accounting and taxation for hybrid financial instruments (with and without capital increase)

■Assessment of integrated/separate treatment

■Accounting and taxation for corporate investors

■Taxation for individual investors

■Accounting and taxation for issuers

Trust accounting

■Accounting for settlors

〇When establishing trusts

〇When selling beneficial interests

〇Handling in case of trust loan

〇Handling for self-declared trusts

■ Accounting for beneficiaries

〇Holding classification and accounting for monetary trusts

〇Presentation and accounting for preferred beneficiary rights

■Accounting for trustees and relationship between trust accounting principles and corporate accounting

〇Amount of trust property and trust principal to be recorded

〇Accounting rule reviews and amendment advice

Trust taxation

■Assessment of trust type

(Scheme and contract provisions to ensure that trusts are not classed as trusts subject to corporation taxation)

■Individual points of debate concerning securitization with a preferred/subordinated structure trust

〇Corporate tax

-Income capturing for preferred beneficiaries and subordinated beneficiaries

-Handling of depreciation and amortization expenses when trust property includes depreciable assets

〇(Withholding) income taxes

-Proposal of scheme and contract provisions to ensure that withholding taxation is not incurred for income on trust property

-Handling when some withholding taxation is incurred on interest on trust property, etc., owing to the status of some beneficiaries as subject to withholding taxation, and related contract provisions

■Accounting and taxation for other new schemes that use trusts

〇Japanese ESOPs (employee incentive plans) (including calculation of guarantee fees)

〇Trusts for dissolution of cross-shareholdings

〇Self-declared trusts

〇Purpose trusts

〇Security interest trusts

〇Specified purpose trusts

Taxation for silent partnerships, etc.

■Accounting and taxation for corporate investors

■Taxation for individual investors

■Withholding taxes for silent partnership dividends

■Provisions against inconsistency in accounting and taxation caused by impairments, etc.

■Handling of failure of funds or silent partnership investors

Taxation for SPCs

■Assessment of satisfaction of requirements for recording dividends paid in profit and loss

■Consideration of applicability for withholding taxation exemption for property managed by SPCs

■Assessment of applicability of special provisions for reduction of transfer taxes (registration and license taxes and real estate acquisition taxes)

■Provisions in securitization plans and contracts to receive tax benefits

Verification of market value for taxation purposes (assessment of risks related to identification as donation)

■Validity of transfer value and assessment of donation risk

■Validity of fees, interest, guarantee fees, etc., and assessment of donation risk

■Taxation if identified as donation or taxed as gain on donation

IFRS and U.S. GAAP

■Handling under IFRS and U.S. GAAP (differences from J-GAAP)

〇Consolidation assessment

〇Assessment of possibility of moving real estate off the balance sheet

〇Lease assessments

〇Assessment of possibility of moving financial instruments off the balance sheet

〇Accounting for financial instruments (market value valuation, etc.)

〇Others

■Reclassification of J-GAAP financial statements to IFRS

International taxation

■International taxation consulting related to structured finance

〇Assessment of risk of identification as PE

〇Summarization of matters related to withholding taxes

■Applicability of withholding tax exemption for interest on private-sector foreign bonds, transfer bonds, etc.

■Withholding taxes for investments in Japanese assets by non-Japanese corporations, etc.

■Border withholding tax collection when managing non-Japanese assets

〇Applicability of exemptions for amount of taxation outside Japan

〇Assessment of applicability of inadequate capital taxation system

〇Assessment of applicability of tax haven system

〇Handling of dividends from non-Japanese subsidiaries

〇Application of taxation treaties

■Scheme creation advice based on the above

■Restructuring advice for existing schemes when there are revisions to taxation systems

*For information about matters related to operating companies (expansion into overseas/Japanese markets), transfer pricing, etc., please refer to “International Taxation.”

We provide assurance services and implement AUP after audit and verification by certified public accountants and certified public tax accountants.

AUP for pools of claims, including housing loan claims, lease fee claims, and consumer loan claims

■Checks of individual claims

〇Calculation of samples based on levels required by rating agencies, etc.

〇Extraction of samples from population

〇Cross-checking against contracts

〇Cross-checking with system data

〇Other checks related to agreed upon procedures

■Accuracy checks for matters stated in instrument explanations

〇Checks of attribute information for pooled claims (distribution of payment dates, interest terms, etc.)

〇Checks of matters stated in relation to financial summaries for major related parties

■Checks via system for registration of assignment of claims

AUP for securitization of loan claims for SPCs holding real estate, etc. (CMBS)

■Checks of information related to underlying real estate (rent roll, past income, list of property summaries, etc.)

■Checks of information related to loan claims, etc. (lists of key terms, tables of repayment status)

■Checks of matters stated in instrument explanations (refer to the above)

AUP for credit default swap (CDS) contracts, etc.

■Checks of applicability of reasons for default

■Checks of whether applicability criteria are satisfied when replacing reference claims

■Pricing services based on certain calculation formulas

Accounting and taxation verification for business plans and cash flow projections

■Verification of the following accounting and taxation items for business plans and cash flow projections for power generation projects, particularly solar power generation, financial claims and real estate securitization, and investment schemes

〇Calculation of profits and losses

〇Calculation of taxable income

〇Calculation of taxes

〇Timing of taxation payments and refunds

Accounting audits for vehicles and funds

We provide valuations of pools of claims expected to be securitized and securitized instruments.

Classification by the type of claim subject to valuation

■Claims pools

〇Corporate loan claims

〇Lease fee claims (individual or corporate)

〇Housing loan claims

〇Consumer loan claims

〇Credit loan claims

〇Accounts receivable claims (current and future claims)

■Loans to vehicles that hold real estate, corporate bonds, investments in silent partnerships, etc.

■The following structured instruments backed by the above

〇Preferential or mezzanine interests in preferred beneficiary rights, corporate bonds, loans, etc.

〇Subordinated interests in subordinated beneficiary rights, silent partnership investments, etc.

■Others

〇Assurance fees for Japanese ESOPs

〇Intangible assets

Classification by purpose

■Purpose of price investigation for specified assets pursuant to the Act on the Securitization of Assets

■Purpose of verification of risks related to identification as donation for securitization and inter-group transactions

■Purpose of calculation of gains/losses on sale at time of securitization (holding subordinated interests)

■Purpose of end-of-term market valuation or notes to market value for claims held, etc.

■Purpose of verification of validity of market valuation manuals prepared by clients