Consulting on preventing legal liability of certified public tax accountants

The legal liability of Certified Public Tax Accountants (“CPTAs”) has increased rapidly as a result of a succession of reforms to tax systems, and as a result, the creation of a system to limit the risk of lawsuits concerning the liability of CPTAs has become a pressing issue.

Of the many professions, CPTAs are said to be professionals particularly vulnerable to becoming targets of lawsuits. The number of CPTA liability lawsuits is increasing on a yearly basis. The number of cases where compensation is paid, and the amount of compensation paid, are also increasing, based on the fact that it is relatively easy to calculate damages.

CPTA corporations and CPTAs should adopt systems that enable them to offer useful services to clients, utilizing various tax laws and regulations, which are frequently amended, while also reducing the likelihood of mistakes when preparing returns and consulting.

At Tokyo Kyodo Risk Management Services Co., Ltd., we offer CPTA corporations and CPTAs consulting services for the prevention of CPTA liability, while also supporting the establishment of systems that manage CPTA liability risk. We also offer insurance coverage that is wider than that of insurance for CPTA liability, such as insurance that adds to the amount of indemnity/fills the difference in terms and conditions.

*CPTA liability = An abbreviation for the liability for compensation of Certified Public Tax Accountants

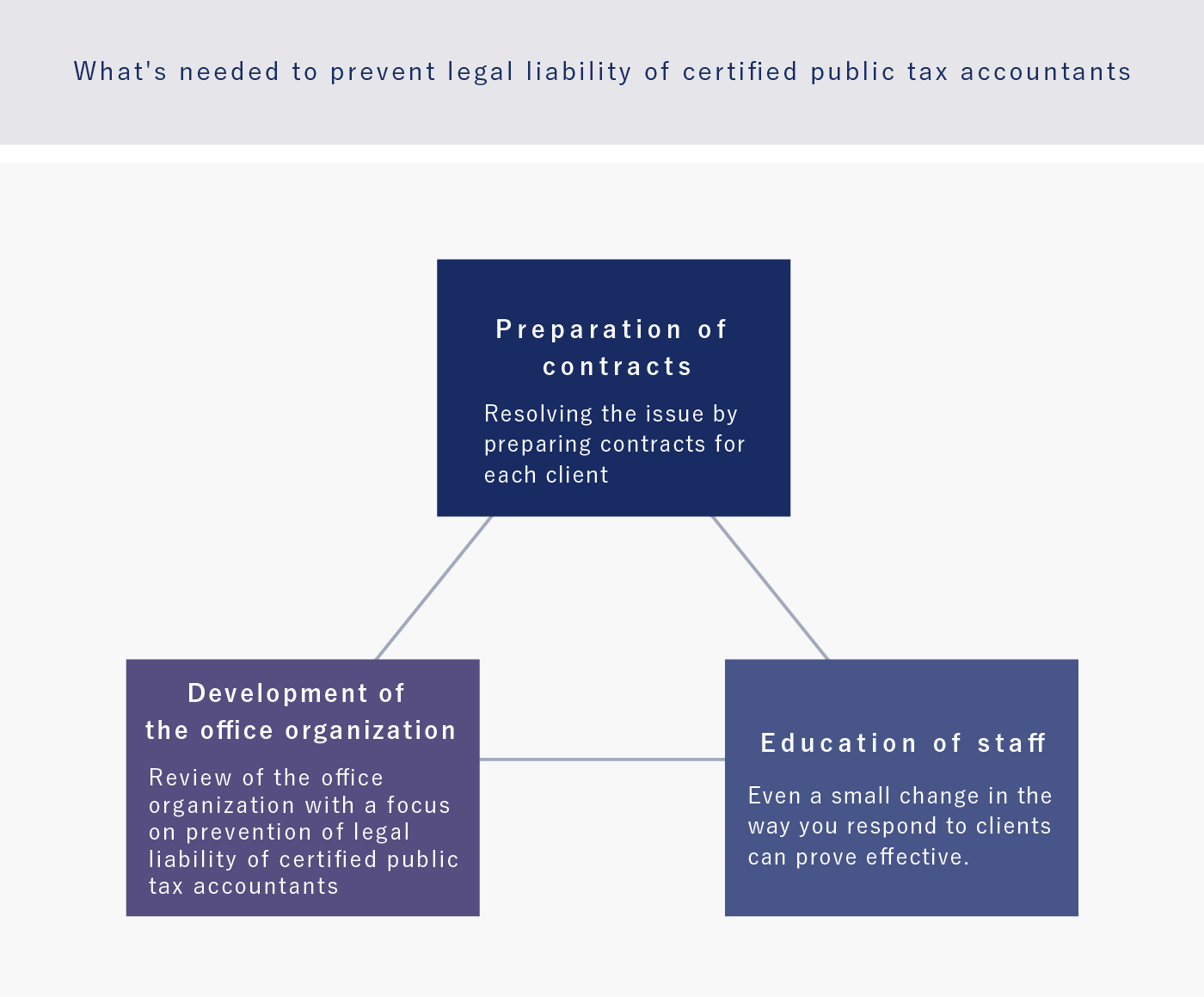

We will diagnose and assess clients’ potential CPTA liability risk, and propose points for improvement to create structures that make it difficult for CPTA liability to occur.

First, we ask clients to complete our CPTA liability risk diagnosis, then we categorize their responses into different areas (advisory contracts, client relationships, organization, consulting), and then we provide assessments based on five levels, from A to E (together with a comprehensive assessment).

We provide clients with information about which items have the potential to cause issues and where improvements can be made to reduce CPTA liability, based on reviews of each item from the perspective of preventing CPTA liability. We also propose specific points for improvement to create a structure that makes CPTA liability less likely to occur across the organization as a whole.

We will also respond to requests from clients for consulting on any specific items.

■CPTA liability prevention consulting

■CPTA liability risk diagnosis and assessment

We aspire to achieve growth while limiting risk by balancing the three aspects of loss prevention, loss reduction, and segregation/diversification.

We will also assist with the creation of risk management systems for CPTA corporations.

Risk management methods for preventing CPTA liability can be broadly categorized into two types: risk control and risk financing. Risk control methods include avoidance, loss prevention, loss reduction, and segregation/diversification. “Risk avoidance” means blocking expected risk by suspending activities that involve risk. It is an effective means of controlling risk, but it is inconsistent with the expansion of the scope of CPTA corporations’ operations, and may result in the suspension of businesses. For CPTA corporations targeting business growth, it is important that they balance the three types of risk control method besides risk avoidance in their operations.

There are two types of risk financing method: transfer and exposure. Exposure to risk means that CPTA corporations must bear any losses that occur. Accordingly, CPTA corporations should remain aware of their risk exposure, and use methods such as insurance to transfer risk.

■Employee seminars on CPTA liability prevention

■Insurance that increases the amount of indemnity/fills the difference in terms and conditions

Tomoko Kubosawa

Consulting on preventing legal liability of certified public tax accountants

Company name

Tokyo Kyodo Risk Management Service Co., Ltd.

Representative Director: Ryutaro Uchiyama

Description of business

Services related to life insurance solicitation, etc.

Location

24th floor, Marunouchi Eiraku Building, 1-4-1 Marunouchi, Chiyoda-ku, Tokyo, Japan

Contact us

+81-3-5220-6200